Pastor, what would you do with an extra $5,000 a month? $10,000 a month?

Every church we work with has one challenge in common: they have more needs and vision than they have resources. Pastors of growing churches all over the country are constantly having to prioritize their budget in this way. Essentially, the church has to say no to something (or someone) in order to be able to say yes to something else. While it’s always important to continue looking for ways to improve giving, we are currently in a time when churches could potentially add six figures of margin to their budget without having to increase their giving.

Long term rates are at their lowest

Right now, the 10-year treasury index is at 1.69%. Put simply, this means that a church with good credit can borrow money on a fixed rate for 10 years less than 4%.

Is this possible? Yes. We have just recently closed on a few projects and refinances where we were able to lock in 10-year rates for 3.95% or less. Most churches who have financed a project or refinanced within the past few years are somewhere between 4.5% and 6% on a 5-year fixed rate.

To put that into perspective, for every million dollars borrowed, a reduction of 1% would equate to ~$10,000 in annual savings. A church with debt of $5M could save as much as $50,000 per year by refinancing, with the benefit of adding more than 5 years to their fixed term.

Flat yield curve

What is a yield curve and why is it important? A yield curve is a comparative chart showing the difference in the short term and long term interest rates. We have been in what’s called a “flat yield curve.” This simply means that there is almost no difference between a short term and long term interest rate. However, we are transitioning into what is called an inverted yield curve, something that has only happened five other times in US history and was created in the past in an effort to curb inflation.

An inverted yield curve means that short term rates are higher than long term rates. Believe it or not, monthly indices (1-Month LIBOR, 1-month treasury, Prime, etc.) are actually HIGHER than a 10-year fixed rate (see below). Right now, as an example, Prime is trading at 5.25%, whereas you can fix your existing debt on a 10-year fixed as low as 3.75%. That’s a 1.5% difference in the interest rate, with the guarantee of keeping that low rate for 10 years without having to worry about the market.

|

|

Index |

10-year Index |

Difference |

| 1-Month LIBOR |

2.05% |

1.69% |

-0.36% |

| 1-Month Treasury |

1.90% |

1.69% |

-0.21% |

| PRIME |

5.25% |

3.75% |

-1.50% |

For churches who are looking at structuring or restructuring their debt right now, I’d also like to point out the difference between short term fixed rates and long term fixed rates. Only a year and a half ago, it was 1.5% more expensive to go from a 5-year to a 10-year rate. Now, as you can see below, the difference is only .04%.

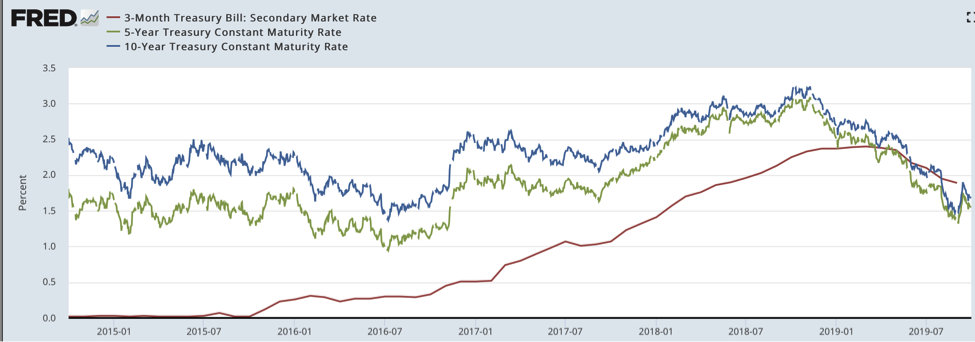

The chart below shows the difference between the 3-month, 5-year, and 10-year treasury indices. The chart below indicates that the gap between the interest rates has significantly closed, nearly representing the same price. (FRED website)

The significance of this cannot be understated. Not only are rates incredibly low right now, but there is almost no difference between the short and long term fixed rates. If you have any existing debt, there is no better time to refinance.

Below is a chart showing the five year interest payment savings based on the difference in interest rates:

| Five Year Interest Savings (standard amortization) |

||||||

| Amount Borrowed |

0.25% |

0.50% |

0.75% |

1.00% |

1.25% |

1.50% |

| $1,000,000 |

$11,860 |

$23,764 |

$35,709 |

$47,696 |

$59,723 |

$71,788 |

| $2,000,000 |

$23,720 |

$47,527 |

$71,419 |

$95,392 |

$119,445 |

$95,392 |

| $3,000,000 |

$35,580 |

$71,291 |

$107,128 |

$143,088 |

$179,168 |

$215,363 |

| $4,000,000 |

$47,440 |

$95,054 |

$142,837 |

$190,784 |

$238,890 |

$287,151 |

| $5,000,000 |

$59,300 |

$118,818 |

$178,546 |

$238,480 |

$298,613 |

$358,948 |

Create margin using “buckets”

One point that gets brought up in this conversation is that while 10-year money is cheap, the problem with having a 10-year note is that you are stuck with a principal and interest payment based on the original principal balance. Meaning, no matter how much debt you pay down, your payment stays the same. While this is true for a home mortgage, there are several options that allow you to have your payments re-adjusted as you pay down your principal: tranches and re-amortization.

A “tranche” of debt is simply an amount of debt within the same loan that is set aside on its own payment plan. By putting debt into buckets, this allows you to have your total monthly payment adjust down as you pay off those “buckets.” For every million dollars borrowed at 3.75% on a 20-year amortization, there is ~$71,000 in annual payments of principal and interest. Using an example of taking a $10M loan and breaking it down into five buckets of $2M each, I would reduce my annual payment by $142,000 every time I paid off a bucket of debt. That’s equivalent to 1.5 to 2 full time salaries, depending on the position, without having to add more income.

Re-amortization is very simple, and this is a strategy we have incorporated on most of our debt deals. This simply allows the church to call the bank and ask them to reset the payment every time you make a significant principal payment. These clauses can be built into the loan agreement and can be exercised multiple times a year with amounts as small as $250,000.

In summary, there really is no better time to look at restructuring debt than right now. This interest rate environment is very rare for a lot of reasons, but as the election year comes up and interest rates look to be re-forecasted, the window of opportunity will not be open for long.

If you are interested in looking into your options, feel free to contact us for a Free Refinance Assessment with no cost or obligation to you. We believe in investing in relationships before we ask for commitments, and we’d love to help you in any way we can!

- Ministry Insights (71)

- Organizational Insights (65)

- Church Growth (55)

- Buildings and Finance Insights (44)

- Leadership (44)

- Facility Strategy (33)

- Financial Strategy (30)

- Organizational Clarity and Strategy (28)

- Digital Engagement (19)

- Digital Engagement Insights (19)

- Multisite (16)

- Buildings and Finance (13)

- Church Debt (13)

- Ministry Growth (11)

- Hiring (6)

- Insight FEATURED (5)

- Featured Insight - Buildings and Finance (3)

- Ministry Strategy (3)

- Merger Insights (2)

- Organizational Leadership (2)

- Strategy (2)

- Church Mergers (1)

- Clarity (1)

- Digital Strategy (1)

- Featured Insight - Project Financing (1)

- Succession Insights (1)